Attackers don’t need AGI

The largest international AI safety review has landed – and for cybersecurity teams, the message is that attackers don’t need AGI to cause serious damage

Read More

Welcome to the new 152 cyber warriors who joined us last week. Each week, we'll be sharing insights from the Black Hat MEA community. Read exclusive interviews with industry experts and key findings from the #BHMEA stages.

Keep up with our weekly newsletters on LinkedIn — subscribe here.

Our weekly delivery of cybersecurity trends and exclusive interviews – here in your inbox.

Key cybersecurity investments and investment trends in 2024.

VC funding in the cybersecurity sector has been through a noticeable stabilisation this year, returning more or less to pre-pandemic levels. Investors are making measured decisions after a period of heightened activity in 2021 and 2022, and opting for sustainable startups that have the potential for long term growth.

At the same time, there’s been a real focus on innovation – with investors choosing to back startups that offer new solutions to existing and emerging challenges across the cybersecurity landscape.

As Awwab Arif (CISO at Bank of Hope) said when we interviewed him for the BHMEA blog, it’s useful for CISOs to forge strong relationships with cybersecurity-focused VCs – because those relationships can expedite the time-to-market for novel security solutions, at the same time as accelerating the speed of problem-solving for the CISO.

“When a VC encounters an entrepreneur proposing a solution aligning with our needs, they can facilitate an introduction,” Arif noted, “allowing us to evaluate the concept further and contribute to the development of a robust product that addresses broader industry needs.”

Notable investments this year include IONIX, an ASM platform which completed a landmark USD $42 million Series A financing round which included funding from new investors, including Maor Investments. Total investment in IONIX has now reached $50.3 million.

And Wiz, a cloud security platform which announced a $1 billion funding round in 2024 – bringing the company’s total valuation to $12 billion.

Overall, VC funding for cybersecurity startups (and particularly those developing AI security solutions) grew significantly in Q1 2024 – with numbers from Crunchbase showing that startups raised almost $2.7 billion across 154 deals.

Between January 1 and May 5 2024, the announced value of private equity and venture capital investments in cybersecurity vendors came to $8.1 billion. That’s a 91% increase from $4.46 billion during the same period in 2023.

And the top 35 venture capital firms that are actively funding AI announced 51 rounds for startups in this space during Q1 – up from 31 rounds in Q1 2023.

Cybersecurity investments have been focused on a range of key areas this year, including:

Heading into this year’s Black Hat MEA in Riyadh, we’re committed to facilitating strong relationships between startups and investors. Beyond that, we’re creating a space for investors to connect with everyone; from early-career cybersecurity practitioners to global CISOs; because those connections create the opportunity for partnerships that can push the needle on positive change in cybersecurity.

We can’t wait to see you there.

Read the blog: The changing roles of Venture Capitalists in cybersecurity

Do you have an idea for a topic you'd like us to cover? We're eager to hear it! Drop us a message and share your thoughts. Our next newsletter is scheduled for 06 November 2024.

Catch you next week,

Steve Durning

Exhibition Director

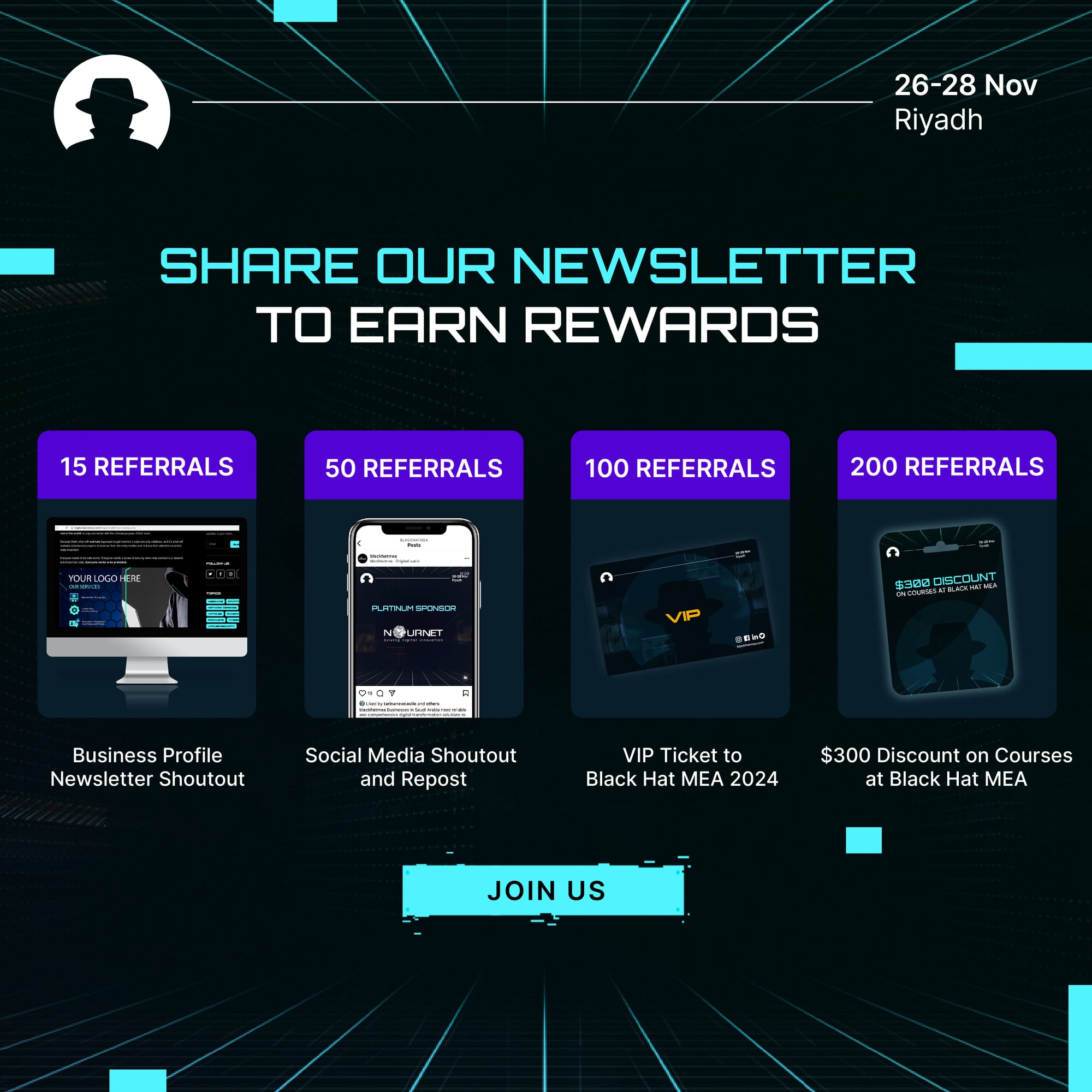

Join us at Black Hat MEA 2024 to grow your network, expand your knowledge, and build your business.

Join the newsletter to receive the latest updates in your inbox.

The largest international AI safety review has landed – and for cybersecurity teams, the message is that attackers don’t need AGI to cause serious damage

Read More

Four exhibitors explain why Black Hat MEA is the region’s most important meeting point for cybersecurity buyers, partners, and talent.

Read More

Why Riyadh has become essential for cybersecurity practitioners – from government-backed momentum and diversity to global collaboration and rapid innovation at Black Hat MEA.

Read More